You may find that you owe the state of iowa more tax when preparing your 2024 iowa tax return in early 2025. For employees paid monthly, jan. Web the rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the flsa if certain requirements are met) from $107,432 per year to $132,964 per year on july 1, 2024, and then set it equal to $151,164 per year on jan. Do not claim more allowances than necessary or you will not have enough tax withheld. Do not claim more in allowances than necessary or you will not have enough tax withheld.

★ ★ ★ ★ ★. Employee withholding allowance certificate tax.iowa.gov. Iowa legal aid can sometimes help with tax problems or questions. Web it's just $50.

Web 2024 iowa personal income tax rates (most tax filing categories) * upper and lower limits of income brackets double for married taxpayers filing a joint return. Send filled & signed form or save. Employee withholding allowance certificate tax.iowa.gov.

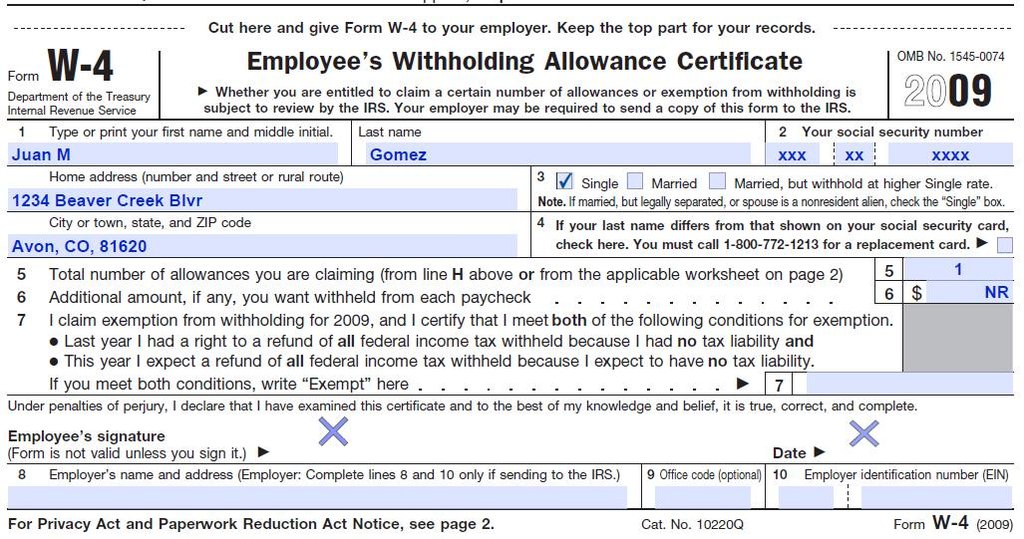

Spanish language assistance is available. Regarding withholding, sf565 replaced number of allowances with amount of allowances to be in line with federal withholding. The biggest change is that it no longer talks about “allowances,” which many people found confusing. Withholding certificate for pension or annuity payments tax.iowa.gov. Do not claim more allowances than necessary or you will not have enough tax withheld.

Send filled & signed form or save. Web the rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the flsa if certain requirements are met) from $107,432 per year to $132,964 per year on july 1, 2024, and then set it equal to $151,164 per year on jan. Withholding certificate for pension or annuity payments tax.iowa.gov.

Web New For 2024:

Do not claim more in allowances than necessary or you will not have enough tax withheld. Do not claim more allowances than necessary or you will not have enough tax withheld. How soon should i do this? If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

For Employees Paid Monthly, Jan.

Employee withholding allowance certificate tax.iowa.gov. You may find that you owe the state of iowa more tax when preparing your 2024 iowa tax return in early 2025. If too much is withheld, you will generally be due a refund. Do not claim more allowances than necessary or you will not have enough tax withheld.

Spanish Language Assistance Is Available.

What it is, how to fill it out in 2024. ★ ★ ★ ★ ★. Withholding certificate for pension or annuity payments tax.iowa.gov. Regarding withholding, sf565 replaced number of allowances with amount of allowances to be in line with federal withholding.

Easily Sign The Form With Your Finger.

Iowa legal aid can sometimes help with tax problems or questions. Shift from allowances to allowance dollar amount; Web iowa withholding formula for wages paid beginning january 1, 2024. Do not claim more in allowances than necessary or you will not have enough tax withheld.

You may find that you owe the state of iowa more tax when preparing your 2024 iowa tax return in early 2025. Web the rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the flsa if certain requirements are met) from $107,432 per year to $132,964 per year on july 1, 2024, and then set it equal to $151,164 per year on jan. Do not claim more allowances than necessary or you will not have enough tax withheld. How soon should i do this? ★ ★ ★ ★ ★.

:max_bytes(150000):strip_icc()/2023FormW-4-64302bb2a6504482bab1e847bbc4cb1a.jpg)