Using direct deposit is very simple. Web updated may 31, 2022. A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account. If you ever heard about the deposit slip? With the help of an aba routing number and bank account number, money can be sent.

Web the direct deposit authorization form is also known by the following names: Then refer to this guide to enter the employee's bank account information in qbo: The netspend direct deposit authorization form should be filled out then submitted to your employer or a company that will be making regular deposits to your account. I hereby authorize [company name] to directly deposit my pay in the bank account (s) listed below in the percentages specified.

This authorization will remain in effect until i modify or cancel it in writing. Similarly, an employer sends the money to the bank. 5 helpful information on setting up your direct deposit authorization form.

Web direct deposit authorization form i hereby authorize _____ to send credit entries, as well as make adjustments and debit entries, as appropriate, to the account(s) indicated below: With the help of an aba routing number and bank account number, money can be sent. Sometimes an employer needs a voided check to make sure that the account. Web setting up direct deposit is as simple as filling out a paper or online form and submitting it to your employer. Similarly, an employer sends the money to the bank.

Sometimes an employer needs a voided check to make sure that the account. Depending on the employer, forms can be completed and submitted via email, or forms can be printed. Set up an employee for direct deposit.

Typically, An Employer Requesting Authorization Will Require A Voided Check To Ensure That The Account Is Valid.

Written by sara hostelley | reviewed by brooke davis. The form is usually intended for a payee to send to the payer. Company name (company you are authorizing to make deposits to your account) account type (checking or savings) bank name. Set up an employee for direct deposit.

Typically, This Method Of Payment Is Preferred By Employees Who Wish To Forgo The Process Of Receiving A Paper Check Rather Than Having To Deposit Or Cash It.

Web to set up direct deposit authorization, follow these steps: Web updated december 13, 2023. Similarly, an employer sends the money to the bank. The netspend direct deposit authorization form should be filled out then submitted to your employer or a company that will be making regular deposits to your account.

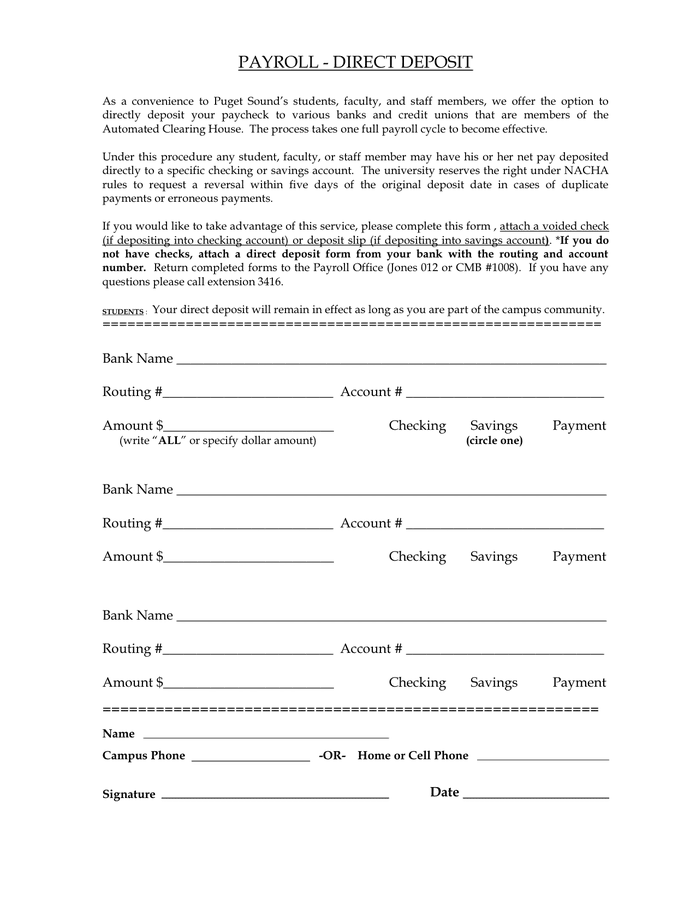

Web Direct Deposit Authorization Form.

· provide accurate personal information, including your name, address, and social security number. A direct deposit form is used to permit a third party to deposit money into your bank account. Web setting up direct deposit is as simple as filling out a paper or online form and submitting it to your employer. This form is usually used if the employee wishes for his/her pay to be deposited to his/her account instead of receiving cash or check.

This Authorization Will Remain In Effect Until I.

· enter your bank details, including the bank name, account number, and routing number. Web direct deposit authorization form. This form is not valid without the signature of the accountholder. Web a direct deposit form template is a document used when an individual is authorizing another individual or company to directly deposit payment to his/her bank account.

This authorization will remain in effect until i. I hereby authorize __________ [employer name] to deposit all payments due to me into the account(s) listed above. A direct deposit authorization form is a legal document letting an employee authorize their employer’s payroll representative to deposit funds directly into their account. Typically, an employer requesting authorization will require a voided check to ensure that the account is valid. Web your personal information (name and address) bank name and routing number.

![Free Printable Direct Deposit Authorization Form [Word Examples] Best](https://i2.wp.com/www.bestcollections.org/wp-content/uploads/2021/03/direct-deposit-authorization-form-6.jpg)