You should use the attached form if you wish to transfer shares you hold in certifi cated form to another person or persons. Web you can sell or transfer shares in a simple way, without having to produce a share certificate shares can be purchased or sold electronically with faster settlements and reduced dealing charges. John smith) country if outside canada or the united. Web crest is important as it ensures that listed stock can be settled electronically (in a dematerialised form). Enter the asx code or company name.

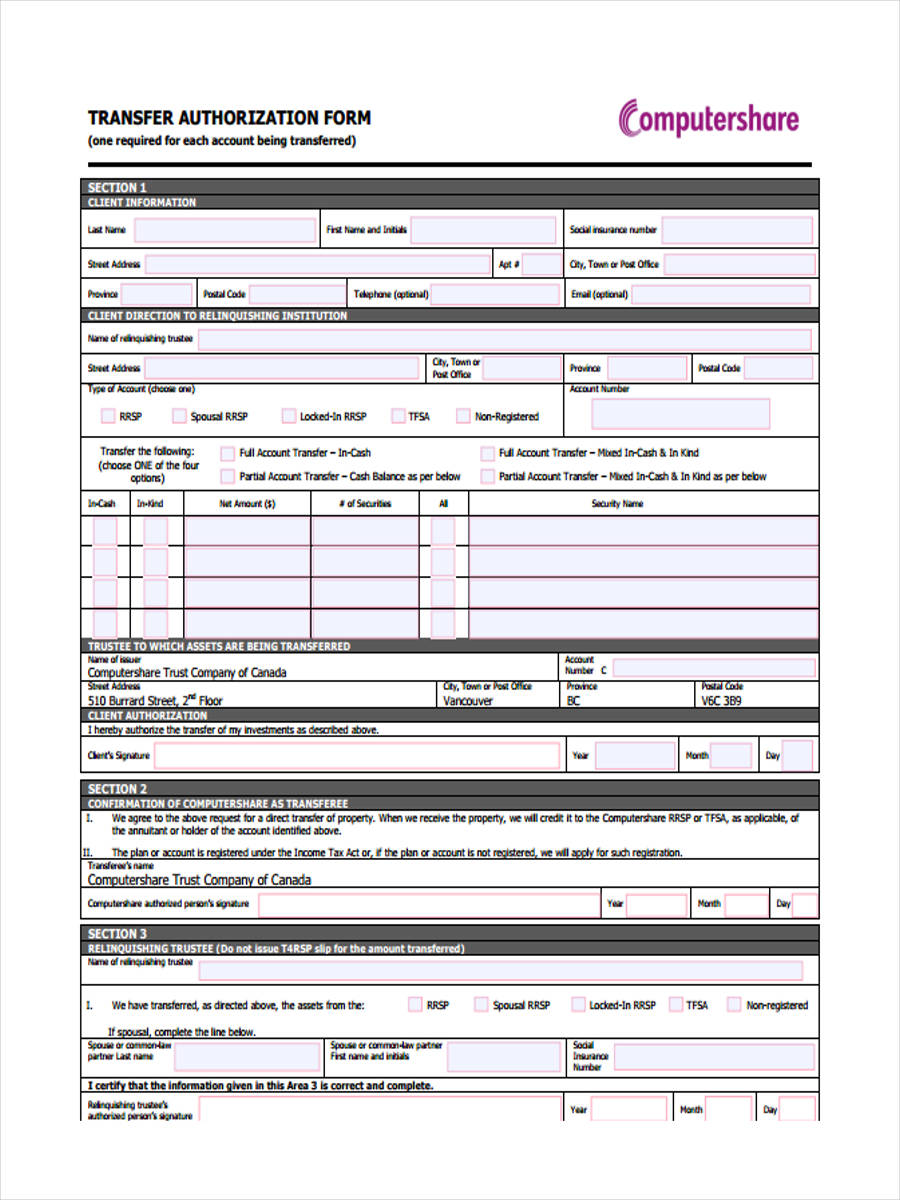

Web the undersigned does (do) hereby irrevocably constitute and appoint computershare as attorney to transfer the said stock, as the case may be, on the books of said company, with full power of substitution in the premises. The certifi cate should be forwarded to the registrar. Web how to complete this form. Web the first thing to do is notify computershare that the shareholder has passed away.

Web transfer qualifies for one of the exceptions listed below, please check the box next to the exception and provide supporting information or documentation (as applicable). We will walk you through the process one step at a time. If the transfer is liable to stamp duty, you will need to obtain a stamp duty certifi cate (see over for details).

You should use the attached form if you wish to transfer shares you hold in certifi cated form to another person or persons. Computershare investor services plc, in conjunction with the companies below, operate the company nominee service for the benefit of private. You do not need to transmit the securities into the name(s) of the executor(s) or administrator(s) before transferring to the benefi ciary(s) and/or buyer(s). Web the undersigned does (do) hereby irrevocably constitute and appoint computershare as attorney to transfer the said stock, as the case may be, on the books of said company, with full power of substitution in the premises. Web download and complete the relevant transfer form for the hl account you want to hold the shares in.

Some types of transfer are liable to hm revenue and customs stamp duty. The signature(s) below on this transfer request form must correspond exactly with the name(s) as Web you can sell or transfer shares in a simple way, without having to produce a share certificate shares can be purchased or sold electronically with faster settlements and reduced dealing charges.

Web How To Complete This Form.

Enter the asx code or company name. If the stock transfer form is incorrectly completed or you have not enclosed the stock certifi cate(s) the stock cannot be transferred. W e are a global leader in transfer agency, employee equity plans, mortgage servicing, proxy solicitation, stakeholder communicatio ns, and other diversified financial and governance services. British government stocks (gilts) computershare investor services plc the pavilions,.

The Signature(S) Below On This Transfer Request Form Must Correspond Exactly With The Name(S) As

If the transfer is liable to stamp duty, the completed form will need to be submitted to the hm revenue and customs stamp. These are also in the ‘useful forms’ section. Web name(s) of registered holder(s) should be given in full, the address should be given where there is only one holder. Some types of transfer are liable to hm revenue and customs stamp duty.

Web This Form Is Used To Transfer The Securities Into The Name(S) Of The Benefi Ciary(S) And/Or Buyer(S).

Web download and complete the relevant transfer form for the hl account you want to hold the shares in. Executor(s) of the person(s) making the transfer. Web transfer wizard is the quickest, easiest and most accurate method to create your transfer documents. Once we are made aware of the change in circumstances, we can stop any activity on the shareholding, such as issue of dividend payments, until we have confirmed the rightful legal representatives, and acknowledge their wishes.

All Surviving Registered Holders (If Applicable) Or A Legally Authorized Representative Must Sign The “Authorized Signatures” Section (Section 8), With A Medallion Signature Guarantee For Each Signature.

Before you send this form refer to the checklist on page 1. We will walk you through the process one step at a time. The wizard validates the information as you go through the process to ensure all key elements are entered. John smith) country if outside canada or the united.

Web transfer wizard is the quickest, easiest and most accurate method to create your transfer documents. If the transfer is liable to stamp duty, the completed form will need to be submitted to the hm revenue and customs stamp. If the transfer is liable to stamp duty, you will need to obtain a stamp duty certifi cate (see over for details). If the stock transfer form is incorrectly completed or you have not enclosed the stock certifi cate(s) the stock cannot be transferred. Web if you have inherited shares or are managing shares for a deceased estate, deceased estate assistant guides you through the process of transfer, sale or finalising the estate.