But if you want to understand. Xyz company has the following contribution margin income statement: Then, fixed expenses are deducted to show the final operating income. How to calculate your contribution margin. — variable costs per unit.

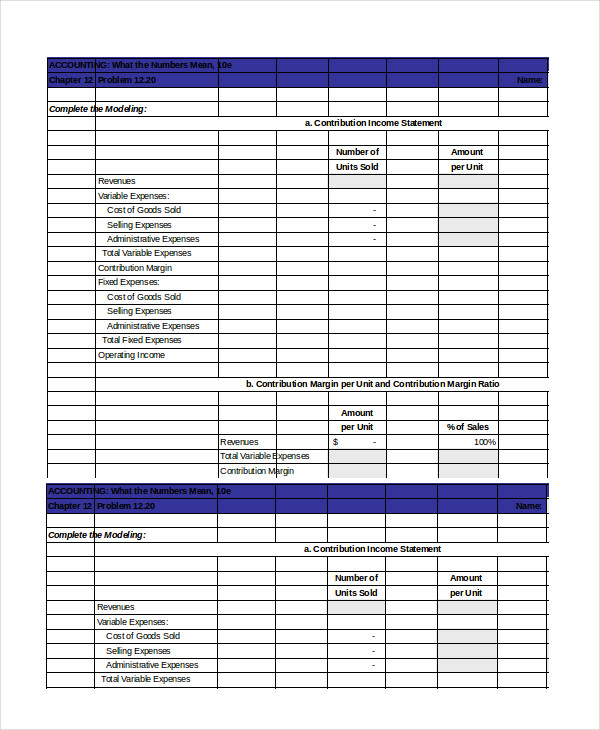

Web 8 minute read. Web this contribution margin ratio template shows you how to calculate the contribution margin, cm percentage and breakeven point. The basic difference between a traditional income statement and a contribution margin income statement lies in the treatment of variable and fixed expenses for a period. What is the contribution margin income statement?

The contribution margin ratio (cm ratio) of a business is equal to its revenue less all variable costs divided by its revenue. Web a contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin. \small \rm {cm} cm — contribution margin;

Contribution Format Statement Template Download Printable PDF

The basic difference between a traditional income statement and a contribution margin income statement lies in the treatment of variable and fixed expenses for a period. Web 4 february 2021 14 min read. All variable costs are included, these might include production, selling, and administration variable costs. Contribution margin can be presented as the total amount, amount for each product line, amount per unit, or as a percentage of net sales. / understanding the contribution margin income statement.

To illustrate how this form of income statement can be used, contribution margin income statements for hicks manufacturing are shown for the months of april. Variable costs are direct and indirect expenses incurred by a business from producing and selling goods or services. Web contribution margin (cm) income statement example:

All Variable Costs Are Included, These Might Include Production, Selling, And Administration Variable Costs.

It represents the marginal benefit of producing one more unit. Web the formula for your contribution margin is: But if you want to understand. \small \rm {cm} cm — contribution margin;

Rashid Javed | Updated On:

In this article, you will learn: Web contribution margin income statement example. Variable costs are direct and indirect expenses incurred by a business from producing and selling goods or services. Contribution margin is a business’s sales revenue less its variable costs.

Web How To Use This Contribution Margin Template When You Download Our Free Contribution Margin Income Statement Excel Template You’ll Get A Blank Sheet That Helps You Calculate Contribution Margin And Food Cost Percentage Per Dish, And A Sheet Filled In With A Sample Calculation.

\small \rm {sp_ {unit}} spunit. The contribution margin ratio (cm ratio) of a business is equal to its revenue less all variable costs divided by its revenue. Web table of contents. How to determine your contribution margin income.

The Basic Difference Between A Traditional Income Statement And A Contribution Margin Income Statement Lies In The Treatment Of Variable And Fixed Expenses For A Period.

The contribution margin 12 represents sales revenue left over after deducting variable costs from sales. Web the contribution margin income statement, by contrast, uses variable costing, which means fixed manufacturing costs are assigned to overhead costs and therefore not included in product costs. Your complete guide to gross profit and margin analysis in income statements. Cost volume and profit relationships (explanations) by:

— variable costs per unit. Web this contribution margin ratio template shows you how to calculate the contribution margin, cm percentage and breakeven point. To understand how profitable a business is, many leaders look at profit margin, which measures the total amount by which revenue from sales exceeds costs. To illustrate how this form of income statement can be used, contribution margin income statements for hicks manufacturing are shown for the months of april. \small \rm {cm} cm — contribution margin;