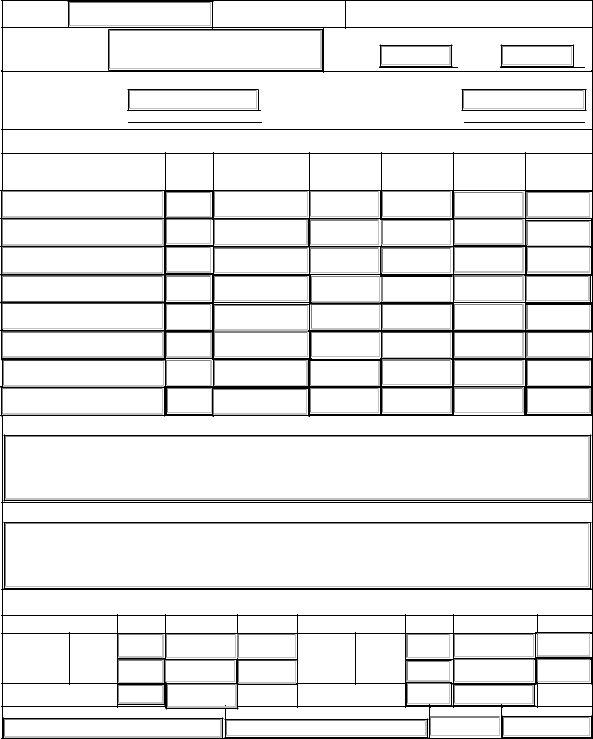

Absence of credit impinges on an underpayment penalty. We last updated colorado form dr 0204 in january 2024 from the colorado department of revenue. You can print other colorado tax forms here. Any person who owns or operates any business in this state. Specific credit is a $5k innovative motor vehicle credit.

Web date (mm/dd/yy) persons with disabilities parking privileges application. (1) a substance shall be added to schedule ii by the general assembly when: How do i get turbotax to include tax credits in line 4a of colorado form 204? You can print other colorado tax forms here.

What needs to be done: Form dr 0004 is the colorado employee withholding certificate that is available for colorado taxpayers. Any person who has obtained gainful employment within this state.

That calculation is designed to withhold the required colorado income tax due on your wages throughout the year, and. Visit tax.colorado.gov for additional information regarding the estimated tax penalty. How do i get turbotax to include tax credits in line 4a of colorado form 204? Web this form should be included with your completed dr 0104 form. Colorado department of revenue subject:

Web date (mm/dd/yy) persons with disabilities parking privileges application. How do i get turbotax to include tax credits in line 4a of colorado form 204? Free legal forms > colorado forms > tax forms > form 204 computation of penalty due based on underpayment of colorado individual estimated tax.

(B) The Substance Has Currently Accepted Medical Use In Treatment In The United States, Or Currently Accepted Medical Use With Severe Restrictions;

Any person who has resided within this state continuously for a period of ninety days. If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay any penalties or fees owed. This certificate is optional for employees. Form dr 0004 is the colorado employee withholding certificate that is available for colorado taxpayers.

You Are Not Required To Complete Form Dr 0004.

If you are using a screen reader or other assistive technology, please note that colorado department of revenue forms and documents may contain instructions, affidavits, checklists, and other important sections that may be missed using the forms/focus mod\. Any person who owns or operates any business in this state. Absence of credit impinges on an underpayment penalty. Web dr 0204 (11/21/22) colorado department of revenue.

You Can Print Other Colorado Tax Forms Here.

Easy step does not subtract the credit and the line 4a, in forms, is not editable. Web a colorado driver’s license or identification document, or an identification document issued by the united states government, for the person who is entitled to use reserved parking. What needs to be done: Tax year ending computation of penalty due based on underpayment of colorado individual estimated tax.

Web Form 104 Is The General, And Simplest, Income Tax Return For Individual Residents Of Colorado.

Free legal forms > colorado forms > tax forms > form 204 computation of penalty due based on underpayment of colorado individual estimated tax. We last updated colorado form dr 0204 in january 2024 from the colorado department of revenue. Web this form should be included with your completed dr 0104 form. (1) a substance shall be added to schedule ii by the general assembly when:

We last updated colorado form dr 0204 in january 2024 from the colorado department of revenue. Absence of credit impinges on an underpayment penalty. (1) a substance shall be added to schedule ii by the general assembly when: Dr 2444 statement of fact author: (a) the substance has high potential for abuse;