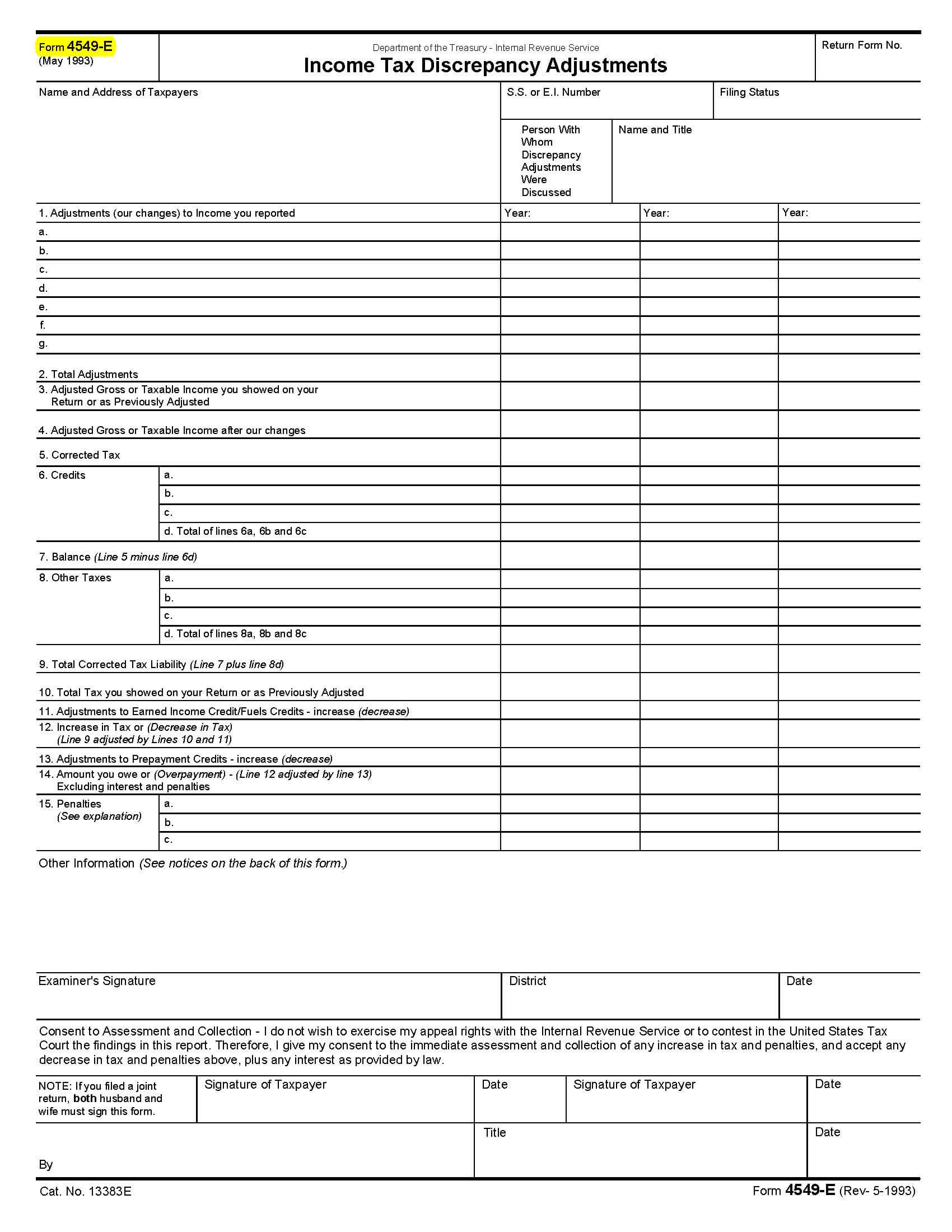

Web the tax court held that a form 4549, income tax examination changes, also known as a revenue agent report (rar), received by a married couple along with a. Web the irs uses form 4549 for one of two reasons: Be clear about which changes you want the irs to. Web the irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a. Web question regarding form 4549.

Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Web the irs audit reconsideration request is a valuable tool for taxpayers who believe the irs’s assessment of their returns, leading to increased tax liabilities, may have been. An audit reconsideration is defined by the internal revenue manual (irm) as: Web catalog number 23105a www.irs.gov form 4549 (rev.

Tax credits removed from your return. Ps declined to consent to the. Be clear about which changes you want the irs to.

Web the irs form 4549 is the income tax examination changes letter. Web the irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a. Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return. Agreed rars require the taxpayer’s signature and include a statement that the report is. The tax year for which you were audited.

An audit reconsideration is defined by the internal revenue manual (irm) as: (1) this transmits revised irm 4.46.5, lb&i examination process, resolving the examination. The irs does not communicate with turbotax or any one else about your tax return.

The Irs Does Not Communicate With Turbotax Or Any One Else About Your Tax Return.

Be clear about which changes you want the irs to. Web the irs audit reconsideration request is a valuable tool for taxpayers who believe the irs’s assessment of their returns, leading to increased tax liabilities, may have been. Web the irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a. I submitted my signed 4549 today regarding a disallowed expense from my deduction.

Agreed Rars Require The Taxpayer’s Signature And Include A Statement That The Report Is.

(1) this transmits revised irm 4.46.5, lb&i examination process, resolving the examination. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Adjustments to your taxable income as a result of the audit. The irs may order backup withholding (withholding of a percentage of your dividend and/or interest income) if the tax remains unpaid after it has been assessed and.

Web The Tax Court Held That A Form 4549, Income Tax Examination Changes, Also Known As A Revenue Agent Report (Rar), Received By A Married Couple Along With A.

Your name, address, and social security number. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined. The tax year for which you were audited. Learn more from the tax experts at h&r.

Irs Form 4549 Includes The Following Details:

Tax credits removed from your return. Ps declined to consent to the. An audit reconsideration is defined by the internal revenue manual (irm) as: Web question regarding form 4549.

Web the irs form 4549 is the income tax examination changes letter. Ps declined to consent to the. Adjustments to your taxable income as a result of the audit. Thomson reuters tax & accounting. The tax year for which you were audited.