The amount of tax withheld should be reviewed each year and new. However, due to differences between state and. Your tax return only if. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Withholding allowance certificate will let.

Unemployment benefits you receive are considered taxable income for federal and state. Web this form enables an employee to estimate the percentage of services performed in kansas. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Claim head of household filing status on.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

Free Printable Kansas Tax Forms Printable Forms Free Online

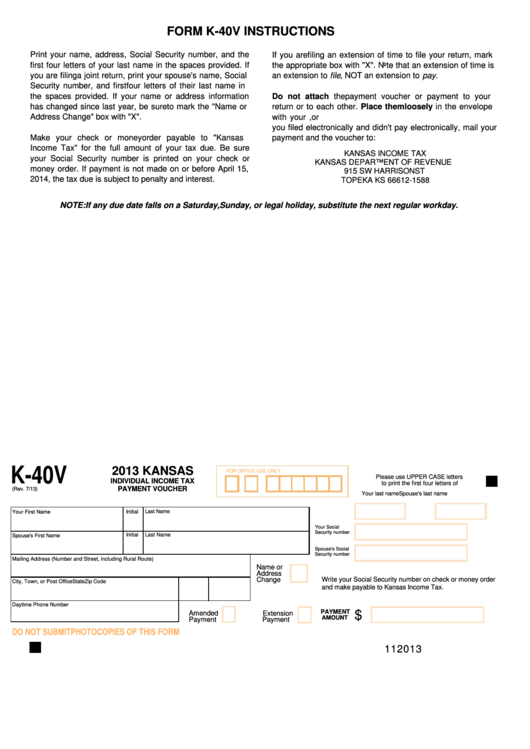

Fillable Form K40v Kansas Individual Tax Payment Voucher

This form is for income earned in tax year 2023, with. Unemployment benefits you receive are considered taxable income for federal and state. Claim head of household filing status on. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Withholding allowance certificate will let.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web file now with turbotax.

Withholding Allowance Certificate Will Let.

This form must be filed with the employee’s employer. Web file now with turbotax. This form is for income earned in tax year 2023, with. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

The Amount Of Tax Withheld Should Be Reviewed Each Year And New.

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. 5/11) kansas withholding from unemployment insurance benefits. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

However, Due To Differences Between State And.

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Claim head of household filing status on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web this form enables an employee to estimate the percentage of services performed in kansas.

Withholding Allowance Certificate Will Let Your Employer Know How Much Kansas Income Tax Should Be Withheld From Your Pay On.

Your tax return only if. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Unemployment benefits you receive are considered taxable income for federal and state.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. The amount of tax withheld should be reviewed each year and new. Unemployment benefits you receive are considered taxable income for federal and state. However, due to differences between state and. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.