Web do you have to pay taxes on stubhub fees? If you receive a 1099 form, it will show your “gross sales” (that’s what you. Got an email saying my stubhub account info changed. Click here to contact us. Web when listing tickets for sale on stubhub, we'll ask you to:

Web do you have to pay taxes on stubhub fees? Web tax forms when selling tickets. English call +44 20 8068 4317. Web when listing tickets for sale on stubhub, we'll ask you to:

Web on tuesday, the internal revenue service surprised many tax professionals and others when it announced that it would delay new requirements for tax year 2023 that would. Web new seller requirements (1099s) received this email today about the tax implications of selling on stubhub in 2022. English call +44 20 8068 4317.

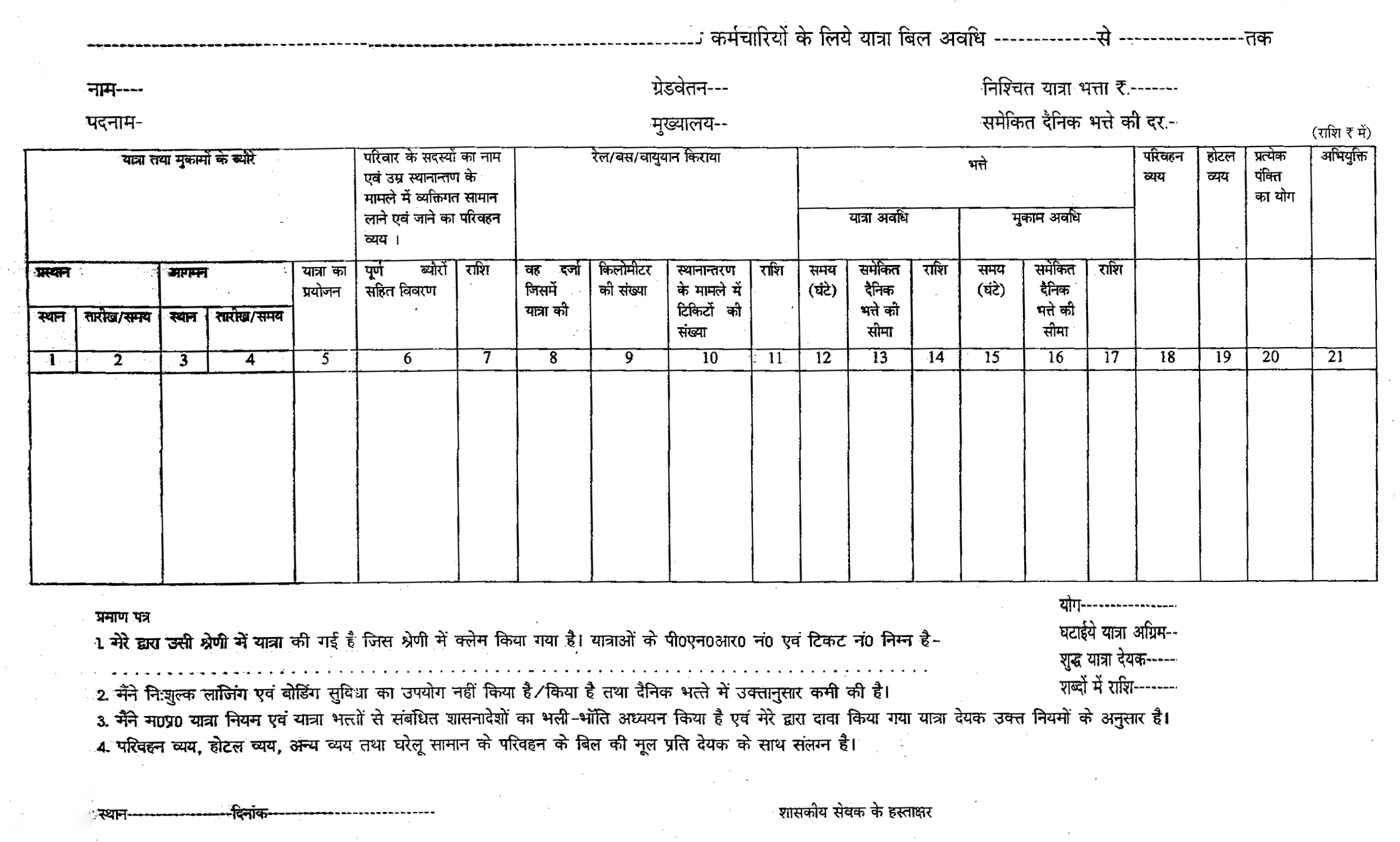

How to Apply Online TA Army Form , How to Join Territorial Army Force

Sellers are responsible for collecting and remitting any and all applicable taxes in connection with ticket sales (international, federal, state, or. Web tax forms when selling tickets. English call +44 20 8068 4317. Changes to the payment services agreement for sellers of european and uk events. After completing your purchase, you'll get a.

Web new seller requirements (1099s) received this email today about the tax implications of selling on stubhub in 2022. I was wondering if i will be receiving the form? Web do you have to pay taxes on stubhub fees?

Web Stubhub Payment Is On Hold Where Can I Find My Bank Account Number And Sort Code?

We usually respond in 5 min*. Web if you have made selling tickets into a business enterprise, then you would enter the income from selling the tickets, and also the expenses, on form 1040 schedule c. Set a price for your ticket (including all applicable taxes) provide complete and accurate info about your tickets. Stub hub will issue a 1099 to you showing the gross amount of your sales.

You Have To Include At Least This Amount On Your Return.

Web maximise your law society membership with my ls. Web buying and viewing tickets as a guest. A lot of thoughts are flying through my mind. Web when listing tickets for sale on stubhub, we'll ask you to:

Spanish Call +34 919 030 010.

Sellers are responsible for collecting and remitting any and all applicable taxes in connection with ticket sales (international, federal, state, or. Web go to the event page. These transaction (ta) forms (ta4, ta6, ta7, ta8, ta9, ta10, ta13 and ta15) are for business and residential property. Got an email saying my stubhub account info changed.

Request An Event To Be Created Using Our.

This form will include the gross amount of the reportable payment transactions made to you on our. Web we would like to show you a description here but the site won’t allow us. Web new seller requirements (1099s) received this email today about the tax implications of selling on stubhub in 2022. Web stubhub will email you requesting for your tin once you reach $20,000 in sales within a calendar year and have conducted more than 200 transactions.

Web on tuesday, the internal revenue service surprised many tax professionals and others when it announced that it would delay new requirements for tax year 2023 that would. Web buying and viewing tickets as a guest. Web maximise your law society membership with my ls. Web meaning, if you sold more than $600 worth of tickets on stubhub, you'd get a tax form and so would the irs. Reselling tickets bought on stubhub.